Exchange Compliance & Reporting

The Axon market data compliance platform reduces your market data compliance risk

Many firms struggle with the ever-increasing complexity and variety of stock exchange policies and administration requirements.

Axon’s technology platform is disrupting market data management practices with its automated processes designed by industry-leading experts with a focus on automating compliance, reporting and policy management.

The platform consists of PEAR, ACT, ADS, ADP and ACR, which provide a consolidated approach to market data management – driving efficiency and productivity.

Who is Axon?

Axon is a technology-driven product and services business with a focus on disrupting the current approach to market data management. Established in 2014 —beginning with Axon’s flagship product PEAR — Axon has gone from strength to strength by using technology to simplify market data reporting and administration.

The Axon Market Data Compliance Platform now provides a full range of products and services to complement PEAR and is recognized by the industry as a leader in its field.

The Axon platform is designed by a team of highly skilled market data professionals — providing you with the highest levels of market data knowledge and expertise.

In June 2019 Axon Financial Systems — the leading provider of exchange policy and compliance solutions — joined the TRG Screen family. The acquisition of Axon will further solidify TRG Screen’s position as a global market leader in enterprise spend management for financial market data.

Policy Updates - Year to Date

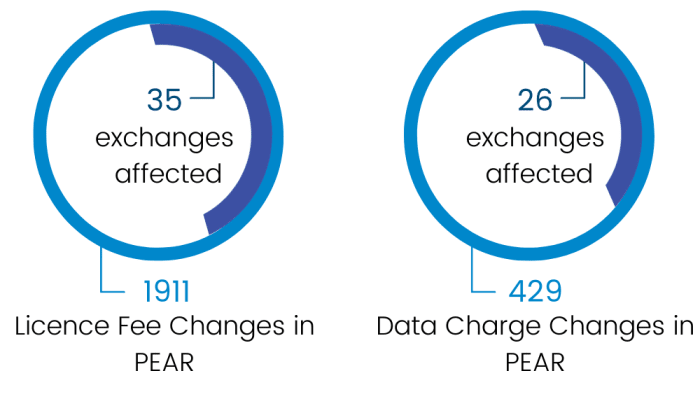

Licence/Data Charge Changes

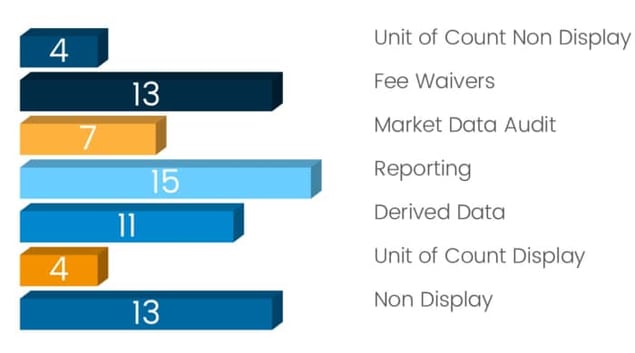

Trending This Month

-min.png?width=630&name=Trending%20this%20Month%20-%20Most%20viewed%20exchange%20and%20policy%20type%20(1)-min.png)

Policy Documents Monitored by Axon

Get in touch

Whether you are a Tier 1 investment bank, an exchange or a hedge fund. Axon's technology platform can help any firm to reduce their market data compliance risk.

Get in touch

Ready to optimize your enterprise subscription spend & usage?

ROI calculatorBlog & news

Contact us

United States (Global HQ)

1 Pennsylvania Plaza

3rd Floor

New York, NY 10119

All international offices- Privacy policy

- Copyright © 2024 TRG Screen